By John Golway, CPA and Founder of Financial Designs Tax Services, LLC

By John Golway, CPA and Founder of Financial Designs Tax Services, LLC

Tax reform has been all the buzz since the holidays. Tax professionals and financial advisers around the country have been busy educating themselves on the new rules. Many people will benefit from the new structure, and medical professionals in a 1099 role may have a lot to gain if they are planful with their strategy. Here at Financial Designs, our tax and investment departments have been working hand-in-hand to ensure our clients get the most out of every dollar earned. Here are some highlights to consider:

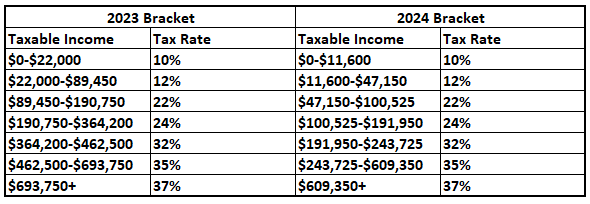

1) Tax Brackets Have Shifted

Pay attention to the new tax brackets. Moving tax brackets can have a significant impact on your take-home pay. For example, if you are married and filing jointly and making $383,900-$487,450, there is a significant incentive to moving down a tax bracket… 32% tax rate vs 24%.

Keep in mind your tax rate is driven by TAXABLE INCOME. As an independent contractor, you can reduce your taxable income by deducting health insurance premiums. HSA contributions, 50% of self-employment tax, retirement contribution (up to $69,000 in 2024*), deductible business expenses, and a minimum of $29,200 in itemized deductions. It may not be as hard as you think to move down a tax bracket.

2) Utilizing the 20% Pass Through Deduction Can Significantly Reduce Taxes Owed

As an independent contractor, you may be able to benefit from a 20% pass through deduction. The goal is to reduce your taxable income below $383,900 (see point #1 for more details on how to do that). At this point you can benefit from a 20% deduction… $383,900 x 20% = $76,780. Assume a 32% tax rate and you are saving $24,570 in taxes.

If your taxable income is between $383,900 and $483,900, you can still save on taxes through the phase-out portion of the new pass through rule.

Finding it difficult to reduce your taxable income to fall below $483,900? If you are interested in simultaneously boosting your retirement savings, work with a financial advisor to explore a Defined Benefit Plan. Although these plans have a moderate administration fee, they can allow you to save $150,000+ in a tax-deductible retirement savings account. The subsequent savings through the 20% pass through rule may far out-weigh the administration fee.

3) The Alternative Minimum Tax (AMT) was Reduced

AMT enforces a minimum tax on the amount of your taxable income above a designated exemption. The tax was to ensure those with higher incomes pay a minimum amount of tax. Otherwise one may not pay income tax because of the amount of deductions and credits.

For AMT, the exemptions increased to $85,700 for individuals and $133,300 for married taxpayers filing jointly. The exemption phase-out also increased to $609,350 for individuals and $1,218,700 for married taxpayers filing jointly.

The bottom line? More people will escape AMT idue to the combination of limited itemized deduction and increased exemption and exemption phase-outs. This could provide beneficial tax planning opportunities for some individuals. Work with your tax professional to discuss more details on tax planning strategies.

4) Luxury Automobile Depreciation was Boosted

The new law increases the limits for business drivers for cars placed in service in 2018 and thereafter. The first-year deduction jumps from $3,160 to $12,200. The maximum amount of allowable depreciation is $19,500 for the second year, $11,700 for the third year, and $6,960 for the fourth and later years. Keep in mind actual deductions must be based on percentage of business use.

5) The Business Entertainment Deduction was Repealed

As an Independent Contractor, have you been deducting the cost of taking co-workers or clients to events like concerts and football games? You can still go have some fun, but under the new tax code, Uncle Sam will no longer subsidize those expenses.

6) The Use of 529 Education Plans was Expanded

Do you have children in the k-12 age range? Thinking about private school or perhaps already enrolled? You can now use $10,000 per year from a 529 plan to cover that private education.

We have been working with medical professionals for almost 40 years, and if we have learned anything, we know that each person’s financial situation is unique. As you check-off the completion of your 2023 tax return, be sure to take the time to set an appointment with your tax professional to discuss your approach to 2024. With the right strategy, you may find your pocketbook a little heavier.

*Individuals over the age of 50 can contribute up to $76,500 annually with a Solo 401(k)

This communication is strictly intended for individuals residing in the sates of AL, AR, AZ, CA, CO, CT, FL, GA, IL, IN, KS, KY, LA, MI, MN, MO, NC, NJ, NY, OH, OK, OR, PA, SC, TN, TX, UT, VA, and WA. No offers may be made or accepted from any resident outside the specific states referenced.

Advisory services available in all 50 states upon request.

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, Financial Designs, Inc. makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to, or your use of third-party technologies, sites, information and programs made available through this site.

Financial Designs, Inc.

11225 College Blvd., Suite 300

Overland Park, KS 66210

Toll free: 888-898-3627 (voice call only)

Local: 913-451-4747 (voice call only)

Fax: 913-451-8191

Contact us today