By Ryan Johnson

If you have taken the step to regularly contribute to your retirement savings: Congrats! You have taken one of the first steps to achieve financial independence. If you are maxing out your contributions ($23,000 for W-2 employees and $69,000/yr for independent contractors*), give yourself another pat on the back. You are done, right? Not so fast.

Unfortunately, contributing the maximum amount to your 401(k), 403 (b), SEP IRA or other retirement account does not necessarily mean you will have all the money you want or need in your retirement years. Especially if you are a physician. As you know, you started your career later than most (due to the grueling amount of school), and you may have significantly more student loan debt than the average person.

It’s imperative you have a way to model what your current savings decisions might amount to in 20, 30 or 40 years. Checkout the hypothetical examples below to further understand how our clients could evaluate their current position and make tweaks as necessary.

Example 1**:

- Lily is a physician that took a W-2 employee job at a local hospital after finishing residency.

- Her spouse, James, does not plan on working.

- Lily and James’s goal at retirement is to withdraw $200,000/year in today’s terms (after tax).

- Lily contributes the maximum of $23,000 to her retirement account (with a 3% employer match).

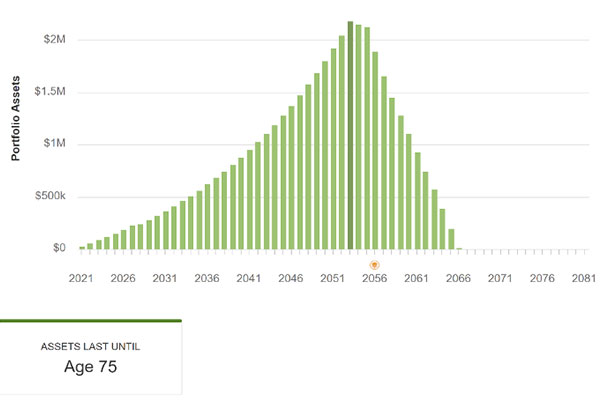

Lily & James’s projected retirement savings:

Even though Lily is “maxing out” her retirement contributions, her current savings approach may not provide the retirement lifestyle she and James were hoping for. In fact, if she chooses to withdraw the planned $200,000 per year, she and her husband will outlive their money at age 75.

This doesn’t mean doom and gloom for Lily and James. Just because Lily is making the maximum contribution to her retirement account doesn’t mean there aren’t other ways to save or adjust their plan so that she and James are well covered later in life.

For example, if:

- Lily and James both contribute the maximum to a Backdoor Roth IRA, assets last until age 80.

- If James decides to work a W-2 employee job and contributes the maximum amount, assets last until age 87.

- Lily and James decide to contribute $2k per month in a non-qualified (after-tax) account, assets last until they die at age 90 and they still have almost a million dollars to pass on to heirs.

- Lily and James decide reduce their goal to something less than $200,000, they can further stretch their assets.

Note: Any of the strategies above can be used in isolation or paired with other strategies. This is not a comprehensive list of all the ways Lily and James could possibly tweak their plan.

Example 2**:

- Wesley is an independent contractor physician.

- Wesley started saving for retirement 10 years after completing residency; at this time, Wesley starts making the maximum contribution of $69,000*.

- Wesley’s goal at retirement is to withdraw $200,000/year in today’s terms (after tax).

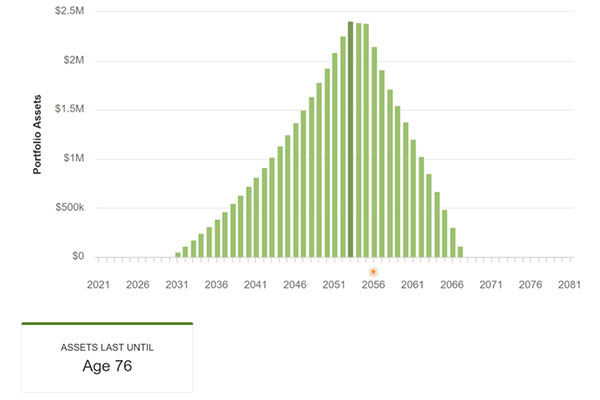

Wesley’s Project Retirement Savings:

Even though Wesley is making a significant retirement contribution every year, starting 10 years into his career really slowed down the potential accumulation. Wesley will outlive his money at 76.

Wesley can supplement just like Lily can in the above example. Additionally, as an independent contractor, there are other ways Wesley can supplement. He could hire a spouse (allowing them to make an additional tax-deductible contribution of $25k ish per year) and/or deploy a Defined Benefit Plan (allowing him to save upwards of $100,000 in a tax-deductible capacity per year).

What else should I know on this topic?

Everyone’s situation is different. You may find you are right on target, over your target or behind your target. Work with a fiduciary who can help you easily determine whether or not you are on track. If you identify that you need to tweak your plan to meet your goals, take the step to do it. Much of the battle is just taking the time to make the change.

Want more updates on hot financial topics? Follow us on Facebook, Twitter and LinkedIn.

*In 2023

** Assumes ROI of 8% and changes to 4% at retirement; retire at age 65

These examples are hypothetical and for illustrative purposes only. The rates of return do not represent any actual investment and cannot be guaranteed. Any investment involves potential loss of principal.

This communication is strictly intended for individuals residing in the sates of AL, AR, AZ, CA, CO, CT, FL, GA, IL, IN, KS, KY, LA, MI, MN, MO, NC, NJ, NY, OH, OK, OR, PA, SC, TN, TX, UT, VA, and WA. No offers may be made or accepted from any resident outside the specific states referenced.

Advisory services available in all 50 states upon request.

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, Financial Designs, Inc. makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to, or your use of third-party technologies, sites, information and programs made available through this site.

Financial Designs, Inc.

11225 College Blvd., Suite 300

Overland Park, KS 66210

Toll free: 888-898-3627 (voice call only)

Local: 913-451-4747 (voice call only)

Fax: 913-451-8191

Contact us today